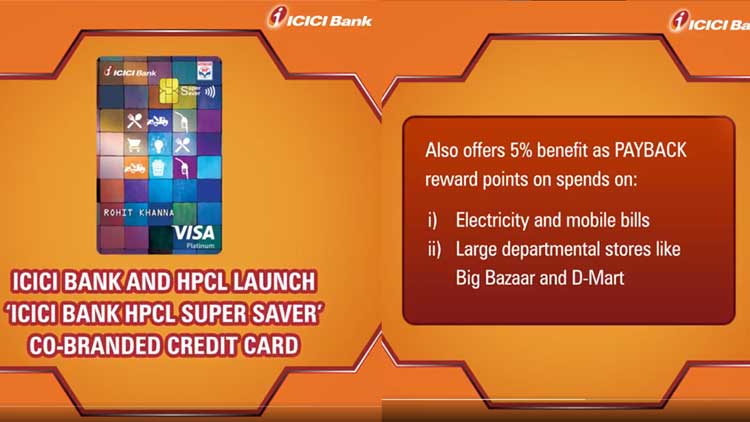

Mumbai: ICICI Bank today announced the launch of a co-branded credit card with Hindustan Petroleum Corporation Limited (HPCL) to provide customers with benefits and reward points for using multiple credit cards in one. The ‘ICICI Bank HPCL Super Saver Credit Card’ provides in-class rewards and benefits to customers on daily fuel spends as well as other categories such as departmental stores like Big Bazaar and D-Mart, electricity, and mobile, and e-commerce portals, among others.

The co-branded credit card is powered by VISA and provides benefits in multiple categories of spends, unlike its peers, which typically offer benefits in only one category, according to a recent statement shared by ICICI Bank.

Speaking on the launch, Mr. Sudipta Roy, Head – Unsecured Assets, ICICI Bank said, “We are delighted to partner with HPCL to launch the ‘ICICI Bank HPCL Super Saver Credit Card’.

How to apply for ICICI Bank HPCL Credit Card?

- Customers can apply for the ‘ICICI Bank HPCL credit card through the ICICI Bank’s internet banking platform or the mobile banking app – iMobile Pay.

- Customers can avail of a digital card in a 100 per cent contactless and paperless manner, which is relevant amid the pandemic. The physical card is also sent to the customer within a few days, said ICICI Bank in its statement.

- Additionally, customers can also manage transaction settings and credit limits on the iMobile Pay mobile app. The existing ICICI Bank credit card can also be upgraded to ‘ICICI Bank HPCL credit card through the iMobile Pay mobile app and internet banking.

Features of ICICI Bank HPCL Co-Branded Credit Card:

Rewards:

- Five per cent cashback on spends on fuel at Hindustan Petroleum retail outlets which includes four per cent cashback and a one per cent surcharge waiver

- An additional 1.5 per cent benefit as PAYBACK reward points on spends on fuel made through the HPCL’s ‘HP Pay’ mobile app

- Five per cent benefit as PAYBACK reward points on spends electricity and mobile spends, along with shopping spends at departmental stores such as Big Bazaar and D-Mart.

- Two PAYBACK points per ₹ 100 spent on all other categories including shopping at local stores as well as e-commerce portals for online shopping

- 2000 PAYBACK points as a joining benefit, which are credited to the customer’s PAYBACK account upon the activation of the credit card

- Cashback of ₹ 100 in ‘HP Pay’ app wallet on the first transaction made using the app worth ₹ 1000 or above

Value-added benefits:

- An annual fee waiver on spends of ₹ 1,50,000 on the card

- Complimentary domestic airport lounge access with the card

- Exclusive discounts on movie ticket bookings through BookMyShow and Inox

- Exclusive dining offers through the ICICI Bank’s culinary treats programme

According to ICICI Bank, the PAYBACK points are credited to the customer’s PAYBACK account which is auto-created at the time of issuance of the credit card.