SINGAPORE — Asia’s emerging markets could become a casualty as a result of U.S. President-elect Joe Biden’s latest $1.9 trillion Covid relief plan.

That’s according to James Sullivan, head of Asia ex-Japan equity research at JPMorgan.

“Most investors were very positive on Asia and emerging markets relative to the U.S.” before details of the latest rescue package were announced, Sullivan told CNBC’s “Street Signs Asia” on Friday.

“We’ve seen over 18 consecutive weeks of fund inflows into Asia ex-Japan over the course of the last couple of months,” he said, adding that it is “highly likely” that funds start to rotate out of emerging markets in Asia back to the U.S. as a result of the boost to economic growth from Biden’s plan.

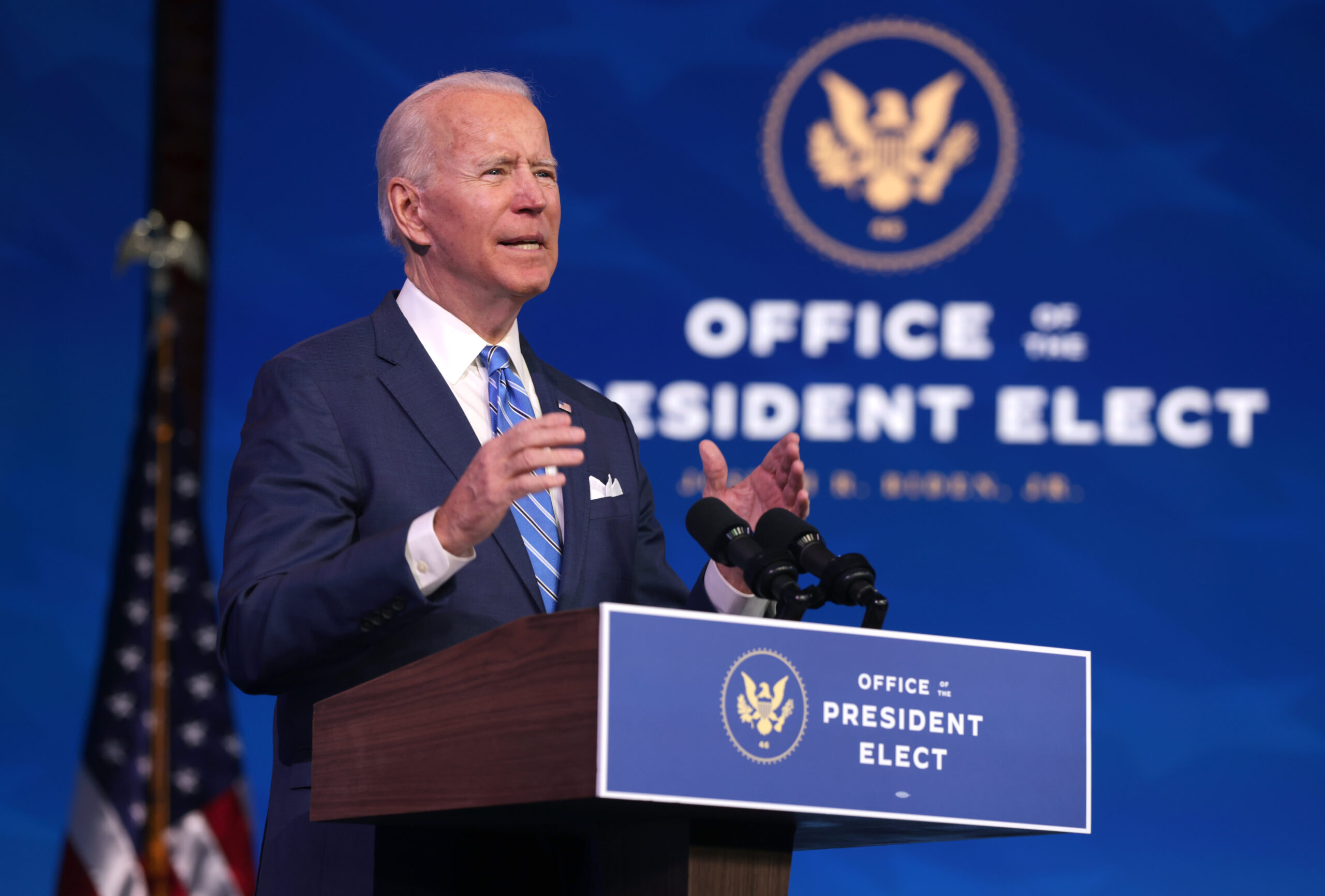

U.S. President-elect Joe Biden speaks as he lays out his plan for combating the coronavirus and jump-starting the nation’s economy at the Queen theater January 14, 2021 in Wilmington, Delaware.

Alex Wong | Getty Images

Biden on Thursday revealed the breakdown of his proposed package, titled the American Rescue Plan, which includes measures aimed at sustaining families and firms until vaccines are widely distributed. The plan includes stimulus checks as well as unemployment support.

Sullivan said JPMorgan previously forecast a two percentage point drag on U.S. GDP as a result of the lack of fiscal stimulus.

“We had baked into our forecast a $900 billion fiscal stimulus package, that drove a move from a 2 percentage point drag to a 70 basis point push to U.S. GDP,” he said of the previous forecast.

With Biden’s $1.9 trillion plan now coming in at more than twice the amount expected by JPMorgan, the analyst said it will be a “positive surprise” for the market as well as for overall levels of economic growth in the U.S.

“Investor fund flows into Asia have been very aggressive over the course of the past couple of months, you could start to see that reverse out,” the analyst said. “I’d say, we’re maybe about halfway through the trade at this stage.”

China’s markets — among the top performers regionally in 2020 — could be among the first to be affected by this shift, Sullivan predicted.

“You’re likely to see the aggressive outperformers of 2020 be a source of funds,” he said. “China would be very much front and center there.”

This article is auto-generated by Algorithm Source: www.cnbc.com